"Risk comes from not knowing what you are doing. This is the map to drive that ignorance away."

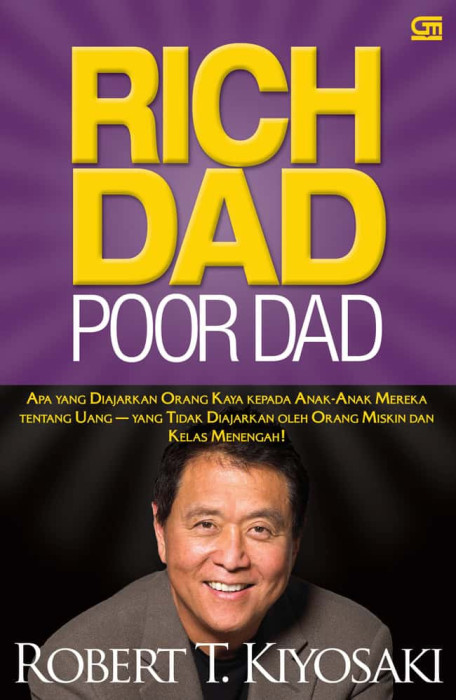

Photo source by Gramedia

Photo source by Gramedia

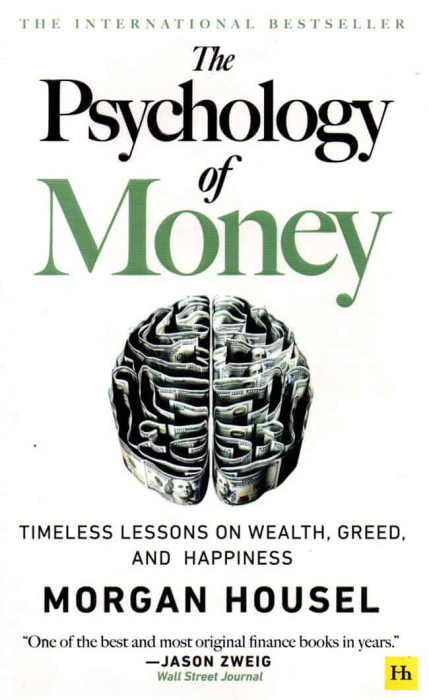

Photo source by Amazon

Photo source by Amazon

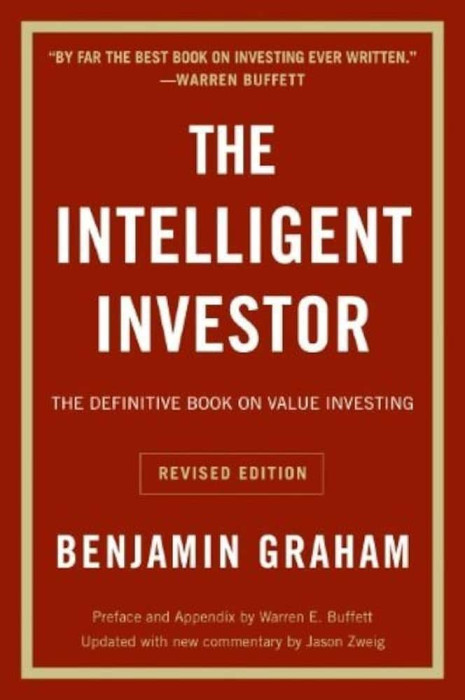

Photo source by Biblio

Photo source by Amazon

Photo source by Amazon