"Why the things we love—from rare musical instruments to ancient tech archives—are now considered more stable investment assets than traditional stocks."

Photo by Markus Winkler on Unsplash

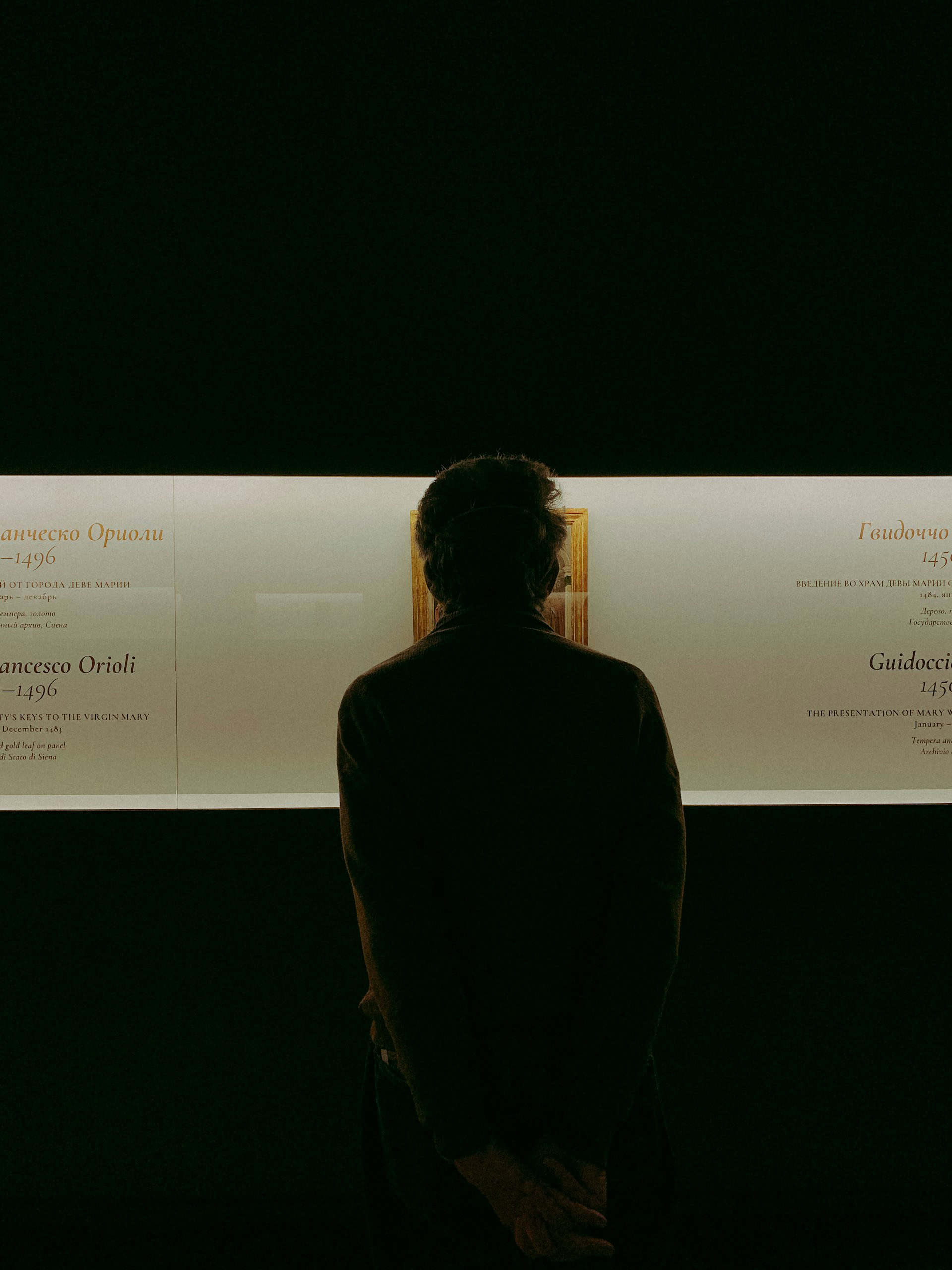

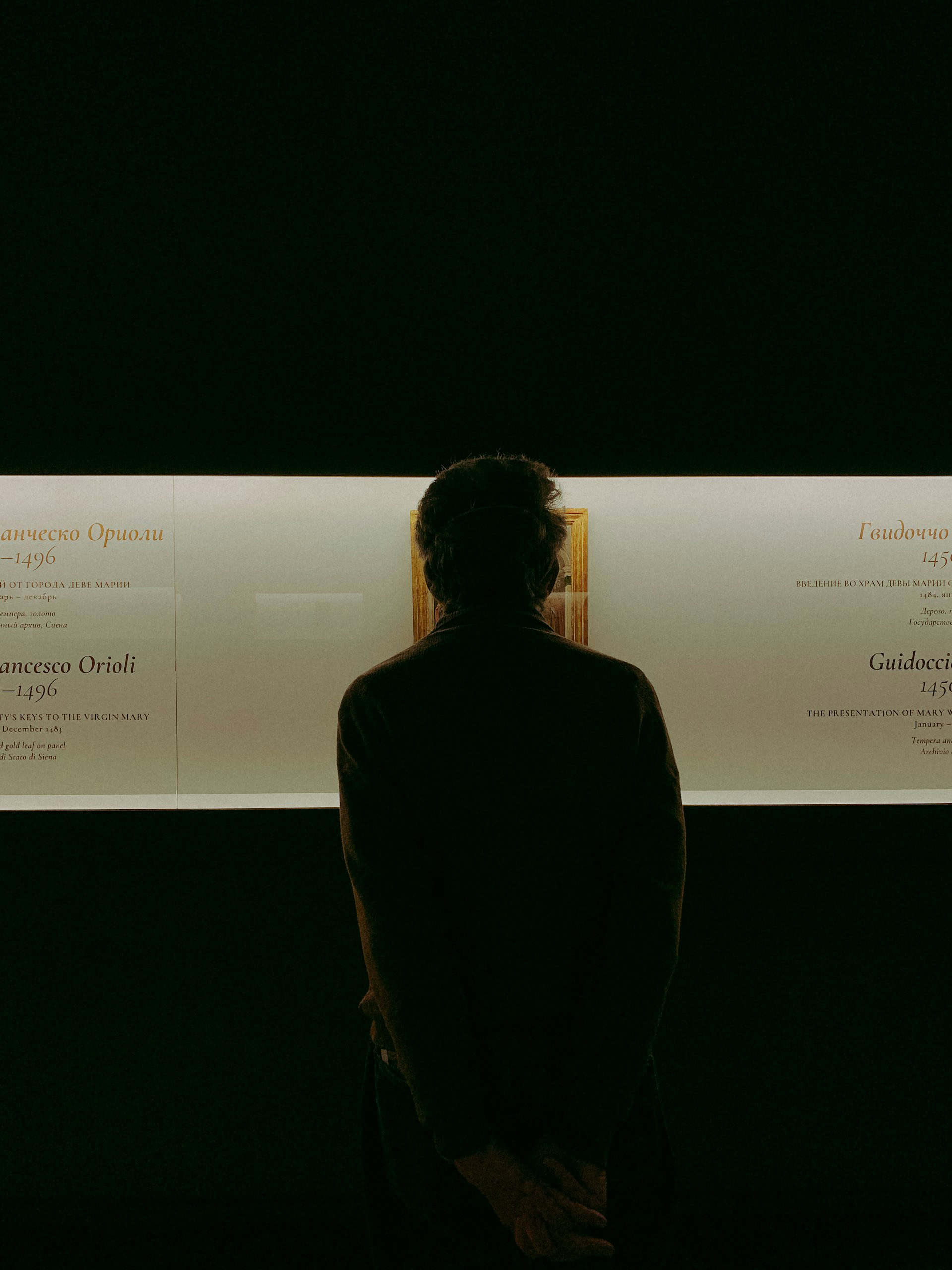

Photo by Martina Carinci on Unsplash

© SR Digital - Alinear Indonesia. All rights reserved.

Home | About Us | Smart Publication: ID | EN | JP | Business & Partnerships | Contact us | Sitemap